|

|

Posted By Louise Probst,

Thursday, November 4, 2021

Updated: Wednesday, November 3, 2021

|

A top concern for employers, BHC, and the public is the high and exponentially growing cost of specialty medications, many of which are biologics. These products, produced from or containing components of living organisms, are the fastest-growing therapeutic class.

While specialty medications meaningfully improve or sustain life for many people, their expense can be thousands to millions of dollars or more per treatment or year. Their unique structure sometimes requires special handling, patient management, or medically-supervised injection or infusion. A review of data from the BHC Pharmacy Management Initiative confirms that specialty medications in the pharmacy benefit represent less than 1% of all prescriptions yet more than 50% of overall drug spending. In the medical benefit, health systems purchase the medication, mark it up, and then bill the plan. The cost can be two or more times higher than what is charged to the plan by other distribution channels, such as the plan’s specialty medication vendor.

Employers have watched this cost trend chisel away at the financial sustainability of their medical benefit for more than a decade. In the early years, a few companies tried a practice coined “brown bagging." The pharmacy benefit manager (PBM) would provide the medication to the patient to be taken by them to the provider visit for administration. Concern for the patient’s ability to adhere to proper handling protocols stunted its uptake. Under an alternative solution called “white bagging” the plan sponsor’s designated specialty pharmacy sends the patient’s specific medication directly to the site of care for administration by the provider at the scheduled time.

Health plans and PBMs are aggressively pursuing this opportunity, and a few BHC members have opted in to their programs. According to Drug Channels, in 2019 nearly a third of drugs infused in hospital outpatient settings were white bagged, including some oncology products. The number of drugs with white bagging arrangements available has grown to 78.

Health systems have noticed and are beginning to push back. Capturing revenues from the administration of these high-cost pharmaceuticals was a major goal fueling the acquisition of physician practices by health systems and venture capital firms. These dollars are an important and planned revenue source. Similar to the tracking of referrals which stay within their systems, specialty medicine administration capture rates are also tracked. To be fair, not all of health system’s concerns are financial. Managed Health Care Executive offers a fair and comprehensive list which is useful to employers seeking to be fully informed before adopting one of these programs.

While not a perfect solution, plan sponsors and patients can save a lot of money. As fiduciaries for their companies and their families, respectively, they both have reason to appreciate these programs. BHC is committed to supporting its members in understanding opportunities to reduce cost while improving or maintaining care quality. Shifting services to more efficient sites of care is a strategy worth considering, and other opportunities are emerging. To aid in this, BHC has enlisted Adam J. Fein, PhD, as a keynote speaking during our November 18th Annual Meeting. Dr Fein is the CEO of Pembroke’s Drug Channels Institute and one of the country’s foremost experts on pharmaceutical economics and the drug distribution system. He is regularly quoted in such national publications as The Wall Street Journal, The New York Times, The Washington Post, Forbes, and many others. I look forward to seeing you at the event (either in person or virtually) and learning together.

Warm regards,

Louise Y. Probst

BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, October 6, 2021

|

The U.S. Department of Labor (DOL) recently announced its first settlement related to violations of the Mental Health Parity and Addiction Equity Act (MHPAEA), a case with UnitedHealthcare, and in doing so reconfirmed that ensuring mental health and substance use disorder parity is one of its highest enforcement priorities. MHPAEA prohibits group health plans from applying financial requirements and conditions for mental health and substance use disorder benefits less favorable than those in place for medical and surgical services. Congress first enacted mental health parity in 1996 and reinforced it in 2008. Yet, concerns remain, as outlined in this 2019 Milliman report, that enrollees needing mental health and substance use disorder services too often face barriers to accessing needed care. Current concerns stem from restrictions in the way benefits are applied: the non-quantitative treatment limitations (NQTLs), such as prior authorization, step therapy, or “must fail-first” conditions, and provider credentialing requirements which may lead to inadequate network coverage for certain services. Hence, the December 2021 Consolidated Appropriations Act (CAA) imposed new requirements on group health plans to ensure their compliance. It requires group health plans to perform and document comparative analyses of the design and application of NQTLs to ensure parity. Plan sponsors must be prepared to submit sound evidence of compliance to the secretaries of the Department of Health and Human Services, the DOL, and the Department of the Treasury within 45 days of a request. The CAA is clear in its intent to hold federal agencies, employers, insurers, and other plan administrators responsible for closing the gap. It requires federal agencies to request detailed comparative analyses from at least 20 group health plans and/or health insurance issuers each year. The agencies are also required to issue a report to Congress each year, and make publicly available information about the comparative analyses, including the names of the group health plans selected, whether the group health plans submitted sufficient information, and whether any of the plans were found not to be in compliance with the MHPAEA. Plans unable to successfully demonstrate parity in the required timeframe are likely to receive a corrective action plan and could be subject to public shaming and financial penalties. Unlike many of the other provisions of the CAA that affect group health plans, the MHPAEA requirements of plan sponsors under CAA section 203 went into effect on February 10, 2021. The DOL has created a self-compliance tool to support plans and insurance companies in meeting the law’s requirements. However, specific guidance on how to quantify and compare the impact of NQTLs is not yet available. These are expected by June 2022. Your plan administrator, PBM, and consulting partner will also have resources to support you on the path to ensuring and confirming mental health and substance abuse parity in your benefit offering. Best, Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, September 8, 2021

Updated: Wednesday, September 8, 2021

|

It has been a little over two weeks since the Food and Drug Administration’s (FDA) approval of the Pfizer-BioNTech vaccine (now marketed as Comirnaty) for the prevention of COVID-19 in individuals 16 years of age and older. With the news comes a decision for employers: to mandate or not? Just last week, results from a Willis Towers Watson survey

of 1,000 U.S. employers stated over half (52%) expect they could have vaccine mandate requirements in place by the end of this year. A positive step forward in encouraging higher vaccination rates, these policies also spur a series of questions for businesses and human resource leaders, including:

- Should employers mandate COVID-19 vaccination as a condition of employment or business relationship? If yes, considerations must be made in defining, implementing, and approving exemptions for employees, customers, or business partners, particularly for those with justified medical concerns or strongly held religious beliefs. For those terminated as a result of vaccine status, SHRM weighs in

on their ability to collect unemployment.

- What is the best process for identifying and establishing requirements for unvaccinated employees? Some options may include weekly testing, masking, and social distancing to ensure adequate protection of other individuals in the workplace.

- What is the appropriate approach for balancing the rights and interests of vaccinated and unvaccinated workers when setting policies and designing plan coverage? Delta Airlines has announced that it will be charging higher premium contributions

for unvaccinated employees. Other private insurers are no longer waiving the employee cost share for COVID-19 hospital admissions, as was standard at the beginning of the pandemic.

As employers consider their response, the several recent and thoughtful articles that follow might be helpful in exploring these issues.

Legality of Vaccine Mandates

Private employers have an absolute right to mandate the COVID-19 vaccine according to workplace attorney, Helen Rella, as quoted in this CBS article

. Other recent media attention is making this legality clear to the public, and perhaps, nudging vaccine uptake. The EEOC COVID-19 technical assistance also seeks to clarify federal laws and support employers in navigating pandemic protocols.

Some Missouri legislators have called for legislation

to stop Missouri employers from mandating vaccination. The BHC has expressed its opposition to any legislative intrusion on the rights of employers to provide for the health and safety of their workers and ensure operational and fiscal sustainability.

Public Opinion Poll Results – Call for Employer Action

Most Americans favor a mandate for those attending crowded public events; half think people should be fully vaccinated in order to go to a bar or restaurant; and vaccinated adults report being more likely than unvaccinated adults to wear masks in public settings and avoid large group settings. These findings, from

an August 2021 poll conducted by the Associated Press and NORC at the University of Chicago, suggest that businesses and workplaces may gain favor by taking action, including making customers and workers fully aware when another worker or customer

is unvaccinated.

According to an August 2021 poll

by Axios, vaccine-resistant Americans are rethinking their position. The proportion of Americans highly resistant to getting the coronavirus vaccine has decreased to 14%. The poll also found that more than three-quarters of Americans either have been

vaccinated or say they are likely to be, up two percentage points from mid-July, according to the index.

Costs and Hospitalizations Among Unvaccinated

COVID-19 hospitalizations among unvaccinated adults cost the U.S. health system billions of dollars

in June and July 2021 alone, despite vaccines being freely and widely available in every state. The statistic is even more startling considering that the analysis used a seemingly conservative Medicare price estimate (commercially insured payments exceed

Medicare rates). Like all health care, this is a societal cost that weighs heavily on American workers.

Dr. Clay Dunagan, Senior Vice President and Chief Clinical Officer of BJC HealthCare, recently presented to BHC members

, blending current science with the impact of the Delta variant on unvaccinated Missourians and the waning resilience of our region's health care systems and their employees. This firsthand account of the challenges health care workers face offers

its own call to action. The positive news is that hospitalization rates may peak sooner rather than later, but ultimately, our ability to mitigate spread and achieve immunity will determine the course of the pandemic.

Closing Thoughts

As with many things in health care, COVID-19 has again poised employers to have a significant impact on employee behavior. While none of these decisions are quick or easy, taking action offers an important opportunity to build trust as an organization that values safety and evidence-based public health measures. Curious how your BHC peers are addressing vaccine requirements? Join us for our next COVID-19 Coffee Chat

on September 27 to hear from fellow members and to learn more about treatment options for high-risk COVID patients.

Warm regards,

Louise Y. Probst

BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Thursday, August 5, 2021

Updated: Thursday, August 5, 2021

|

The Supreme Court of the United States recently declined to hear an appeal filed by the American Hospital Association (AHA) to override a lower court’s decision enabling the Centers for Medicare & Medicaid Services (CMS) to enact site-neutral payment policies, opening a huge savings opportunity for all. A simple concept - equal payment for a service regardless of where the service was performed - has been discussed for almost a decade and hotly contested in the courts over the past few years. The CMS savings estimate alone was $800,000,000 in reduced outpatient payments in 2020.

Traditionally, CMS and private health plans have been willing to pay significantly more for outpatient services performed at a hospital-owned site of care than at a physician or non-hospital owned site of care. This was done to recognize that hospital-owned facilities may be staffed or equipped for higher risk patients and may be subject to stricter regulations. In April 2021, AHA released a study which showed that Medicare patients who received care in a hospital outpatient department were more likely to be poorer and have more severe chronic conditions than Medicare patients treated in an independent physician office.

Yet, there is another side of the story. Medicare Payment Advisory Commission research, conducted in response to a request from Congress, found that paying hospital outpatient departments at a higher rate has driven provider consolidation and created havoc in the marketplace for health care services. Responding to incentives to maximize profit, hospitals have gobbled up physician practices and dramatically expanded the number of sites billing as hospital outpatient departments.

According to the Alliance for Site Neutral Payments, these misaligned payment policies have greatly diminished the number of independent physician practices nationwide and driven costs higher for patients, employers, and taxpayers.

The savings opportunity ushered in by this Supreme Court decision comes without impacting quality or reducing coverage and brings financial benefit to employees as well. In fact, Families USA calls it an overlooked victory for consumers.

We encourage you to talk to your health plan about their transition to site-neutral payments and to stay tuned for strategies to inform and engage employees in capturing this opportunity.

Warm regards,

Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Annie Turner,

Wednesday, July 28, 2021

Updated: Wednesday, July 28, 2021

|

The St. Louis Area Business Health Coalition (BHC) has been recognized as a Gold COVID Stops Here workplace for achieving a 100% vaccination rate.

The COVID Stops Here campaign recognizes Missouri workplaces that have achieved widespread vaccination against COVID-19. Businesses that have achieved at least a 70% vaccination rate are eligible to receive a designation.

"As an organization dedicated to improving health in our community and nationally, we are committed to stopping the spread of COVID, and widespread vaccination is a key step in achieving that goal," said Lauren Remspecher, Senior Director, Member Engagement & Communications, for the BHC. "Our employer members share this vision, and we look forward to continuing to support them in keeping their employees (and their family members) safe during the pandemic."

The Missouri Chamber of Commerce and Industry developed the COVID Stops Here campaign as a way to celebrate workplaces that are leading the fight to stop COVID-19, and to encourage more organizations to join their ranks.

“The COVID-19 vaccine is Missouri’s pathway to recovery. The St. Louis Area Business Health Coalition is helping set the bar for vaccination in Missouri by achieving Gold COVID Stops Here status — meaning 100% of their employees are now vaccinated against COVID-19. This is a great achievement and we thank them for helping our state stop this dangerous virus,” said Daniel P. Mehan, president and CEO of the Missouri Chamber. “Employers are playing a very important role as we work to encourage vaccination in Missouri. In order to finally put this virus behind us, we need Missourians to get vaccinated as soon as possible. Together we can stop this virus - let’s make sure that COVID stops here!”

Learn more at mochamber.com/CovidStopsHere. About the St. Louis Area Business Health Coalition

The St. Louis Area Business Health Coalition (BHC) is a nonprofit organization representing nearly 70 leading employers, which provide health benefits to thousands of lives locally and millions nationally. For 39 years, the BHC has worked to achieve its mission of supporting employer efforts to improve the well-being of their employees and enhance the quality and overall value of their investments in health benefits. To accomplish these aims, the BHC centers its work on providing pertinent research, resources, and educational opportunities to help employers understand best practices for the strategic design (and informed use) of benefits to facilitate high-quality, affordable health care. To learn more, please visit

www.stlbhc.org

or follow the BHC on Twitter

and LinkedIn.

Attached Thumbnails:

This post has not been tagged.

Permalink

| Comments (0)

|

|

|

Posted By Louise Probst,

Wednesday, July 7, 2021

Updated: Thursday, July 8, 2021

|

Last month the Food and Drug Administration (FDA) approved Aduhelm, Biogen’s new intravenous treatment to slow the progression of Alzheimer’s Disease (AD), and in doing so set off a firestorm of controversy that may take years to sort out. The FDA used the accelerated approval pathway, intended for a drug that treats a serious or life-threatening illness and that provides a meaningful therapeutic advantage over existing treatments. The agency and some patient advocates argue that, despite a lack of convincing evidence that the drug works, this is reasonable given that there are no effective medicines

to slow or reverse AD, and none have been approved in almost 20 years.

Of the 11 physician researchers and clinical experts on the independent FDA advisory panel, 10 voted against approval and one voted uncertain. They claimed that the available evidence created significant doubt that the drug will slow the progression of AD and may bring potentially serious adverse effects, with their own impact on cognition, such as brain swelling, brain bleeds, headaches, confusion, dizziness, and falling. The side effects are common and potentially serious enough to require all patients taking Aduhelm be monitored with routine MRI scans. Three members of the advisory panel

resigned over the FDA’s disregard for the science, failure to communicate its change in position regarding endorsement, and a concern that the approval would slow meaningful progress in combating AD.

It seems that significant research targeting amyloid over the past twenty years has failed to produce convincing evidence of causality. Biogen had abandoned Aduhelm, stopping two clinical trials before their completion due to disappointing results. Only later upon closer examination did it note that findings in one of its studies suggested a slowing of the disease for patients with early cognitive decline. As part of its approval, the FDA will require Biogen to conduct a new randomized, controlled clinical trial to verify the drug’s clinical benefit. It has given them 9 years to complete the research. If the trial fails to verify clinical benefit, the FDA may initiate proceedings to withdraw approval of the drug. Eli Lilly and others had invested in and shelved their drugs to treat the amyloid present in AD due to disappointing results. Lilly has now announced that it will seek approval for Donanemab during 2021 under the FDA’s accelerated approval process. Other similar drugs, previously shelved, are expected to also be presented for approval.

There is an ongoing debate about the clinical relevance of amyloid in cognitive decline. While amyloid plaques and protein tangles are commonly found in patients with AD, evidence that they cause the disease’s devastating memory loss or that reducing the amyloid will yield clinical improvement has yet to be demonstrated. Some researchers fear that approval of these drugs and their potential blockbuster profits will consume resources and research dollars better directed toward other causative factors, such as blood pressure or inflammation. Follow up interviews with members of the FDA advisory panel reveal that in November 2020 the FDA told them that it would not be counting the drug’s ability to reduce amyloid as an indication that Aduhelm might be effective, but in June and without further communication to or evaluation by advisory panel members, the FDA reversed course. Esteemed neurologists, other physicians, researchers, policy experts, and journalists are speaking out about the FDA’s action. Congress has initiated hearings into the relationship between Biogen and the FDA.

Biogen has priced the drug at $56,000 annually per patient and projected it would be used by 1 to 2 million patients per year. With related imaging and other treatment costs, the expense is expected to be $100,000 per patient. While some think this utilization estimate is overstated, most agree that the expense is

out of reach for even Medicare. Depending on the numbers, the drug is projected to add between $6 to $29 billion to Medicare Part B drug spending, more than the U.S. spends each year on NASA or the Environmental Protection Agency. Many claim that dollars would be better spent on developing better evidence for other therapeutic interventions that reduce the burden of disease.

There is more to come on the outcome of this FDA decision. The Centers for Medicare and Medicaid is considering its options with regard to coverage of these unproven medications. While employer-based plans will have less demand for treatment and immediate financial impact than Medicare, we know all too well that the cost of U.S. health care is borne by all and most directly shouldered by American workers. Self-insured employers will want to discuss coverage options with their insurance partner and watch for CMS’ decision and the outcome of further investigations of the FDA’s decision. One thing seems clear, employers may need to reconsider their use of FDA approval as a standard for the efficacy and safety of a medication. Time will tell.

For those interested in the aging brain, 60 Minutes did a six-year update of findings from a NIH-funded research study at the University of California Irvine last fall. It provides a fascinating look at the lives of several

nonagenarians and potentially instructive real world insight into the presence and impact of amyloid on memory and cognition. Warm regards, Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, June 2, 2021

Updated: Wednesday, June 2, 2021

|

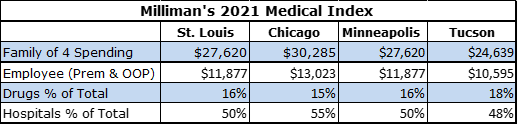

For the first time in its history, the Milliman Medical Index (MMI), released last month, found that health care costs decreased year over year, with the restated 2020 MMI value 4.2% below Milliman’s 2019 MMI. All categories of care, except prescription drugs (with and without rebates), are lower. As employers have experienced, care forgone during the pandemic more than offset the cost of COVID-19 testing and treatments. In the early months of the pandemic, concern arose over the long-term impact of delayed and forgone care. While it is too soon to fully understand the clinical consequences, Milliman suggests that much of the deferred care may actually have been eliminated, noting that lifestyle and care access changes ushered in by the pandemic may have reduced short-term health care needs. Social distancing practices led to an uptick in utilization of digital health, telemedicine, and mail order pharmacy services, which also likely contributed to overall lower utilization of other services. Yet, the potential for increased utilization driven by pent-up demand for treatment of ongoing disease conditions lingers.

The MMI reports that the 2021 cost for a hypothetical American family of four in an employer-sponsored PPO plan is $28,256. The cost represents a projected growth of 8.4% over 2020, a rate higher than seen in many years. A forecasted rebound in health care utilization and continued uncertainty drive this trend. Vaccine rates and efficacy, increased demand for care, changes in work routines and personal health behaviors, public health and provider response and practices, and the prevalence and effectiveness of care management in the months ahead all contribute to this uncertainty. Ensuring convenient and affordable primary care access and coordinating care to leverage employees’ new-found health habits are important opportunities for employers to realize a flatter cost trend while supporting better health.

Cost varies by the population and region. Milliman offers an interactive tool that employers can use to create a MMI for various metro areas and their average family definition. The table included below compares the projections for St. Louis and several other metro areas where BHC members have employees.

The BHC will continue to monitor local and national trends and looks forward to hearing from members on their successes and experiences. The BHC has also hired Milliman to analyze Midwest Health Initiative (MHI) data and provide St. Louis market and provider-specific spending and cost trends for 2020 and the preceding years. Output is being planned for fall 2021. The BHC is eager to share these results with members and to engage with health plan and health system leaders on shared opportunities to realize better population health and lower health care spending trends. Warm Regards, Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, May 5, 2021

Updated: Wednesday, May 5, 2021

|

Recently released survey results confirm what anecdotal conversations have been hinting at for some time: business executives’ attitudes related to health care spending and the role of government in providing coverage and lowering costs have changed. The survey report, How Corporate Executives View Rising Health Care Costs and the Role of Government, taps into the thinking of more than 300 business leaders from diverse industries, each with more than 5,000 employees. The research was a collaborative effort of the Kaiser Family Foundation and the Purchaser Business Group on Health and was funded by the Gary and Mary West Health Institute. Significant concern for health care spending and cost growth is widespread among employers. While organizations believe that they have some ability to control costs, such as with plan and payment design, they recognize that many solutions are outside of their control. Uncertain of how much longer they will be able to shoulder the growing financial burden without government intervention, business executives did not assign one factor as the predominant driver of excessive cost or identify a “silver bullet” solution. The survey asked the executives to rate four contributing factors to high costs: fee-for-service payments, provider consolidation, drug costs, and unhealthy behaviors. Provider consolidation is an area where the government has clearly failed the American public over the past several decades. Ninety-four percent of respondents felt it was a very large, considerable, or moderate factor in driving high health care costs. Historically, business executives have been believed to prefer market-based solutions in order to transform health care, and they likely still do. Yet, health care industry insiders have held significant power over the regulatory and other mechanisms that enable markets to work effectively. As a result, Americans pay between two to four times more for prescription drugs than citizens of other countries and reimbursements from businesses and their workers are two to three times above those of Medicare. These recognitions may be the financial sense behind changing employer attitudes. In some way, those higher prices have been a hidden tax imposed by health systems and other suppliers on American workers, while policymakers pretended not to notice. The survey is important because little research has attempted to identify and quantify the attitudes of business executives on the cost of providing health benefits. Even with these results, much remains to be understood about businesses’ health policy preferences, although it cannot be ignored that a surprising 83% of respondents reported that a greater government role in providing coverage and containing costs would benefit their business. These results come in conjunction with the end of the Biden Administration’s first 100 days in office, turning attention to its social and health care policy agendas. Although not included in the President’s American Families Plan announced last week, it is expected that initiatives, such as those to lower the eligibility age for Medicare, expand the range of covered health services, and empower the government to negotiate prescription drug prices are in the wings. So buckle up for a fierce debate of ideas before the November 2022 mid-term election when all 435 seats in the United States House of Representatives and 34 of the 100 seats in the United States Senate will be contested. Warm Regards, Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, April 7, 2021

Updated: Tuesday, April 6, 2021

|

If there is one thing that has been made clear by the COVID-19 pandemic, it is that few of us, or our families, are immune to the risk of financial insecurity or job loss. Financial well-being is critical to overall well-being. Financial stress, like other forms of stress, takes its toll on physical and mental well-being. When it comes to the workplace, it can impair employee performance, productivity, morale, and safety and also lead to physical ailments such as headaches, fatigue, hypertension, depression, and other chronic conditions. With this in mind, it is clear that financial well-being programs are a must-have for programs designed to support worker health and productivity. As we emerge from the pandemic and its lingering economic outcomes, it is time to consider new ways to support employees’ financial well-being. Even before COVID-19, research found that concerns about personal finances distracted one in three employees while at work, and other research from the Federal Reserve, published in May of 2019, revealed that 40% of Americans would have to borrow money or sell something to cover a $400 emergency expense, 17% of U.S. adults were unable to pay all of their bills every month, and 25% of Americans skipped necessary medical care because of cost concerns. An effective workplace financial well-being program requires an understanding of employees’ financial lives. We all perceive the amount of money needed to support a feeling of financial security differently, so a common definition of financial well-being is necessary to design effective workplace programs and assess progress made over time. Research from the Consumer Financial Protection Bureau (CFPB) defines financial well-being as a state of being wherein a person: - Has control over day-to-day, month-to-month finances;

- Has the capacity to absorb a financial shock;

- Is on track to meet financial goals; and

- Has the financial freedom to make the choices that allow him or her to enjoy life.

This toolkit from CFPB includes case studies and tips for starting financial well-being conversations with employees and cultivating this level of understanding.

Employee financial well-being programs offer an array of financial education programs and services, such as loan and financial counseling, that can support employees through tough financial situations. The Social Policy Institute at Washington University in St. Louis and the National Fund for Workforce Solutions have collaborated on a Guide to Employee Financial Wellness to help employers identify the best program for their team. The guide combines four years of research and best practices collected from a wide range of employers. It outlines six steps to selecting and implementing an employee financial well-being program. Additionally, a trip to the Social Policy Institute’s website finds several new tools to support worker’s financial well-being, like this app that enables easy payroll savings deductions or this research paper on short-term, zero interest loans for low and moderate wage workers. Warm Regards, Louise Y. Probst BHC Executive Director

This post has not been tagged.

Permalink

|

|

|

Posted By Louise Probst,

Wednesday, March 3, 2021

Updated: Wednesday, March 3, 2021

|

March has arrived and brings memories of the pandemic’s beginning. Only a year ago, we were implementing new safety policies, and many of us were transitioning to remote work, without knowing how long these accommodations would be needed. While it is still not clear when "normal" will return, there is some good news regarding the impact of our prevention efforts. As we reflect on the past year and the path forward to recovery, the BHC is turning its focus to opportunities to build resilience among individuals, organizations, and communities in a post-pandemic world.

A quick look at this NPR site

shows the severity of each state's coronavirus outbreak, with an easy toggle to track vaccines, new cases, hospitalizations, and deaths. New infection rates vary across the country and are organized into four risk categories of

green, yellow, orange, or red based upon the number of new daily cases per 100,000 people.

Categorized as yellow,

Missouri is reported to have eight new cases per 100,000 people and 476 average daily cases as of March 3, indicating the need for continued social distancing and mask usage. Along with Oregon and Hawaii, Missouri is among the lowest states for

new infections, although community spread has yet to be stopped. All of Missouri’s bordering states are experiencing higher rates of new infections, ranging from 13 to 30 new daily cases per 100,000. Arkansas is categorized as a red risk level, having

unchecked community spread, along with ten other states. New York and New Jersey tie for the highest at 38 new daily cases per 100,000 people.

As of the date of this post, COVID-19 vaccines have reached 15% of Americans, and about 1.7 million vaccines are being administered per day. Missouri lags a bit at only 13.6% of residents having had one or more vaccine, with state leaders expecting that everyone who wants a vaccine will be able to get one by July. Dr. Fauci reports that if 75-80% of Americans accept vaccination when offered, the U.S. should reach herd immunity

by the end of second quarter 2021 and be close to our previous “normal” by the end of 2021.

The current data on new infections suggests that Missouri’s collective commitment to prevention is working. Thanks to everyone for remaining vigilant. The data also shows that the rate of spread in states can change from week to week. Staying the course is essential. So is building our reserves so as to be positioned for the next novel virus or other public health challenge.

The BHC's Community Forum on April 29 has been designed to identify steps that we can take as individuals, businesses, and communities to build resilience in a post-pandemic world. Keynote speaker Dr. Martin Seligman (also known as the "father of positive psychology") will share the

science of fostering personal and organizational resilience, as well as growth following trauma, rather than stress. The CDC’s Deputy Director for Infectious Diseases, Dr. Jay Butler, will follow with insights on lessons learned from COVID-19 and opportunities

to strengthen our public health and primary care infrastructures for future infectious threats. A panel of local leaders will close the event, reflecting on a shared to-do list to support recovery in the St. Louis region, including economic stability,

health care strategies, and technological innovation. Registration for this virtual conference

is free for BHC members, and we hope that you will join us for an upbeat morning focused on creating a better future.

Warm Regards,

Louise Y. Probst,

BHC Executive Director

This post has not been tagged.

Permalink

| Comments (0)

|

|